- Bookkeeping

- Software on USB

- Taxes

Solopreneur

Level One Services

- *Take Over exiting books from QuickBooks, Xero, Zoho or Fresh Books etc and continue to Categorize and reconcile one bank feed of one account statement, One Charge card Statement, Prepare month end report (Balance Sheet, Income and P&L) sent by email in 15 days of next month.

- Up to $5,000 monthly expenses and/or up to 15 transaction

- Cash-based P&L and balance sheet based on your bank and credit card activity

- Standard chart of accounts

- 15 minutes of administrative time

- You pay the saas subscriptions or our use free software

- For Additional Services See “EXTRA SERVICES FEES”

What's included

Small Business

Level Two Services

- *Best for: Startups and growing businesses that rely on books to make operational decisions. Get detailed information for path to implement to grow.

- Includes everything in Solopreneur.

- Up to $10,000 monthly expenses and/or up to 50 transaction.

- Real-time visibility into your finances

- Cash and/or accrual-based P&L and balance sheet.Data enriched from all your tools and systems

- Custom chart of accounts

- Unlimited bank feeds and charge card statements.Prepare month-end report sent by email in 15 days of next month

- For Additional Services See “EXTRA SERVICES FEES”

What's included

Business Plus — Extra Service Fees

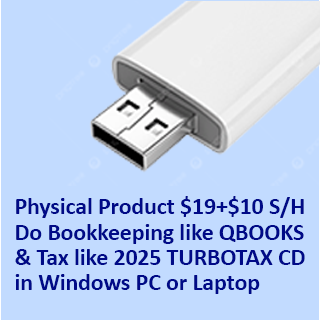

Bookkeeping & Tax Software on a USB

$29 one-time fee

The bookkeeping program has no expiry year — it will work forever.

Note: This is not a TURBOTAX CD copy. The tax filing format is the same as approved by the USA IRS (Federal).

Authenticity & Usage

The software versions are not cracked, pirated, time-trial, or restricted. You can prepare unlimited books and tax files for individuals or businesses.

One next-year update will be provided free via email if/when released by the IRS and the developer.

Product Details

- Works on Windows 10 or 11

- Not compatible with Mac, Apple, iOS, or Linux

- Help available via included PDF guide

- Physical USB Pen Drive

Shipping & Delivery

We test each USB drive before shipping. Orders usually ship within 4 business days.

Important: You are not paying for the software (it is free). You are paying only for labor/time, USB hardware, and shipping/handling.

NO REFUNDS • NO RETURNS • NO CREDITS • NO CHARGEBACKS

Basic

$79

(Includes Fed + 1 State)A simple tax situation, such as single or married with no dependents.

- Single or married

- No children or dependents

- Taxable income under $100,000

- Standard deduction only

- W-2 wages, salaries, unemployment

- Earned Income Credit

Deluxe

$89

(Includes Fed + 1 State)Those with kids, investments, child care, college, or home ownership.

- Taxable income under $100,000

- Children or other dependents

- Investment or retirement income

- Child care and education tax breaks

- Itemized deductions (mortgage, etc.)

- Retirement savings credit

Premium

$99

(Includes Fed + 1 State)Self-employed, freelancers, contractors, or complex income sources.

- Self-employment income & business deductions

- Taxable income over $100,000

- Rental or farming income

- Partner/shareholder income (Schedule K-1)

- Beneficiary income from estate/trust

- Unreported tips & uncommon sources